Branch Expansion Strategy

Branch Expansion Strategy

We believe that a thorough, in-depth analysis of each potential market and facility is, in reality, a very small investment compared to the cost of establishing or acquiring, or modifying, a branch office.

This is especially true when compared to the total investment in acquiring or improving just one facility with staff, promotion and so forth. It is essential to assure the institution that it is utilizing its offices and equipment to attract the most customers possible, in assuring those customers the most convenient service, and, thereby, assuring the profitability of that office or equipment. After all, it is the market that determines the likelihood of success of a branch office of a financial institution.

We Provide Branch Expansion Strategy Actions for the Next Three to Five Years

When we are engaged to perform a feasibility study (branch expansion strategy) for a market or markets for a client, we provide the financial institution with identification of appropriate expansion actions for the next three to five years, or whatever period the financial institution deems appropriate.

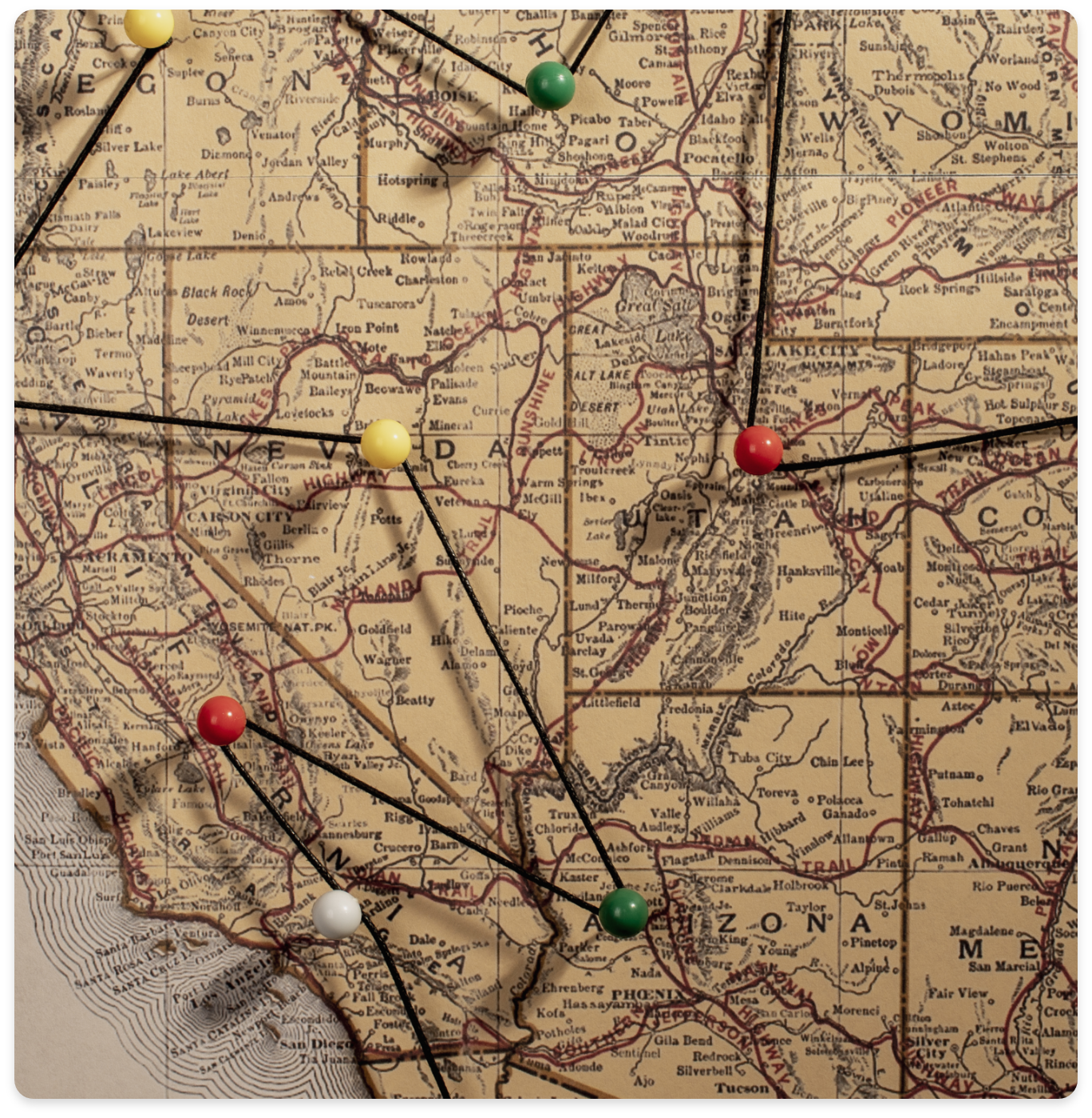

Upon completion of the analysis, we would then prepare a complete, illustrated, detailed report, along with appropriate maps, charts, graphs, and tables, showing all findings and conclusions, and making specific recommendations on the market, on a priority basis, not only on future potential based on economics, demographics, psychographics, and sociographics, but, as well, on the optimum facility and equipment actions that should be taken in the market.

Per Recommended Site

Projected Specific Loan and Deposit Levels

This detailed analysis and report would provide you with the projected specific loan and deposit levels that can be expected from each recommended location over a five-year period based on a highly-accurate proprietary deposit and loan volume model which utilizes over 100 different factors and measurements.

The model used in these projections carefully weighs a number of salient factors in the market, including, but not limited to:

- Population

- Projected Population

- Population Change

- Projected Households

- Past Households Growth

- Age Distribution and Median Age

- Population Growth Analysis by Age Groupings

- Male/Female Ratios

- Per Capita Income

- Household Income Distribution

- Median Household Income

- Average Disposable Household Income

- Auto Loan Potential

- Home Loan Potential

- Savings and Investment Potential

- Retirement Plans Potential

- Median Owner-Occupied Housing Value

- Travel Time to Work

- Education Levels

- Unemployment and Employment Stability

- Competitive Posture of the Institution versus Competitors

- Traffic Counts

- DOT Plans and Projections

- Attractiveness of the Site versus Typical Sites

- Ingress and Egress of the Site versus Typical Sites

- Visibility of the Site as Versus Typical Sites

- Existing Market Share of the Client in the Market

- Existing Customer and Accounts Distribution of the Client in the Market

- Competitiveness of Products and Services in the Marketplace

- Physical Barriers That Exist in the Marketplace

- Numerous Other Factors

Methodology

In completing a Master Branching Analysis, which is the proprietary name of our Branch and ATM Location Program, our staff performs, based upon availability of the data, the following for the defined market area:

- A complete analysis of deposit growth, by category, for all financial facilities in the defined areas, and an analysis of what growth in each category are occurring for each facility.

- Projections of growth for each facility in the defined marketplace.

- A complete analysis of the defined marketplace to determine penetration by all financial institutions and ATMs, total available market potential within the respective market area, savable and disposable income within the marketplace in general, and all other data that would be necessary to make an intelligent decision on future branching activities within the market.

- A seven to nine year plotting of actual performance, where available from NCUA, FDIC, Comptroller of the currency, and other reports, of each financial institution in the defined market area, utilizing the highly-sophisticated TLG Branch Deposits and Loans History and Projections Program so as to establish actual facility performance as versus perceived performance.

Gathering Client Info Bearing Heavily on Subsequent Analysis

An important component of conducting a Master Branching Analysis is for our folks to gather certain information about the financial institution that will bear heavily on the subsequent analysis such as the following:

- The philosophy of the organization with respect to facilities, i.e., Free-standing on fee simple ground; free standing on leased ground; store-front; other.

- The maximum capital expenditure for the establishment of facilities and equipment under a variety of scenarios.

- The type of customer base being sought by the institution through new or improved facilities in each market.

- The relative weight of new markets in terms of being lending markets, savings market, or a combination of each.

- Growth projections for the institution for the next three-to-five years with and without addition and/or changes of facilities, on an “as is” basis, and on other bases.

- Services and products emphasis for facilities under various scenarios.

- The length of time that the institution is willing to “carry” a new or improved facility until it reaches a break-even point.

- The impact of various growth and expansion scenarios on the ROA of the financial institution.

- Locational profiles of the existing customer base in the area under consideration.

Use Of Client Information

Information that we gather from the client institution is necessary in determining not only the optimum placement or modification of facilities and equipment, but to determine the likelihood of financial success of facilities and equipment under a variety of scenarios.

Our approach to branch analysis and planning work is somewhat different than that of many firms. While all firms such as ours use various reports, publications, computer analyses, etc., in making recommendations, it is our long standing practice to use this information only as supportive data. We feel quite strongly that good analysis work requires a significant amount of time and legwork on-site, and as a result, much of our time is spent in the field. In fact, we are, to our knowledge, the only firm in the business that confidentially visits every financial institution in the defined market, inventories every financial institution, and actually drives the entire market before making recommendations. This approach has proven most successful for our clients.

Our findings, conclusions, and recommendations made as a result of an analysis are most specific, with exact recommended locations and exact format recommendations.

Also, we do not engage in the design or construction of facilities. We believe that to be able to provide a purely objective analysis, we should not be in a position to further benefit from decisions made on the basis of that analysis. Some firms, whose main business is building facilities, also provide analyses, often at low or no cost, but in our opinion, cannot be objective and impartial.

Once Sites Are Selected

Once selected, the recommended sites are photographed, plotted on maps and thoroughly described to the financial institution expressing advantages and disadvantages for each particular location.

Recommended actions to be taken will be listed for you on a priority basis.

TLG produces a five-year deposit growth model that is conservative and accurate on each individual recommended retail location. Our projected deposit and loan performance model aids management in deciding which site (s) to acquire.

Many times proposed locations are priced significantly different or one site may have issues that may be complicated and time-consuming to deal with; such as a need for re-zoning or the need of demolishing an existing building on the property. Our growth model can simplify the decision making process for you by giving you information on the deposit and loan growth that will occur for each location we have recommended.

We Recommend The Type Of Office

We then suggest the type of office that should be deployed, specifically either a free-standing branch office, an in-store branch office (located usually in a shopping plaza), a LPO office, an ATM deployment or a purchase or lease of property for land-banking purposes for future retail use. It is essential to the Bank that it is using its offices and assets to attract the most customers possible. It is also advantageous to deploy branch offices that are as convenient as possible so that additional accounts will be more apt to be added by each customer. By offering potential customers or members the most convenient service possible, profitability of that office or equipment will be more ensured.

Contact Us Today!

Take the next step…in planning your financial institution’s new office, relocation or expansion.

Get Answers To Your Most Pressing Questions

After a detailed analysis of your financial institution and its markets, we can provide you with answers to some of your most pressing questions:

- Should we branch at this time?

- Are our branch offices strategically placed to optimize market share?

- Are the conditions for branch expansion right?

- Should we acquire a location in a strip mall or should we acquire land and invest in brick and mortar?

- Should we open an LPO office first? What conditions justify this?

- What conditions should be present to know that closure or branch merger is the right option?